Have you ever found yourself wondering what drives a company to acquire 30 other companies in just 22 years? I certainly have. When I look at the Tata Group’s remarkable journey of acquisitions—from the iconic Tetley Tea in 2000 to the recent takeover of Air India in 2021—I can’t help but ask: What’s the bigger picture here?

They say, “The proof of the pudding is in the eating,” and Tata seems to be cooking up something quite extraordinary. But what exactly are they trying to portray?

As someone who’s always been fascinated by business strategies, I decided to delve deeper into Tata’s acquisition spree. And let me tell you, it’s nothing short of a corporate saga worthy of a Hollywood script—think “The Big Short” meets “The Wolf of Wall Street,” but with an Indian twist.

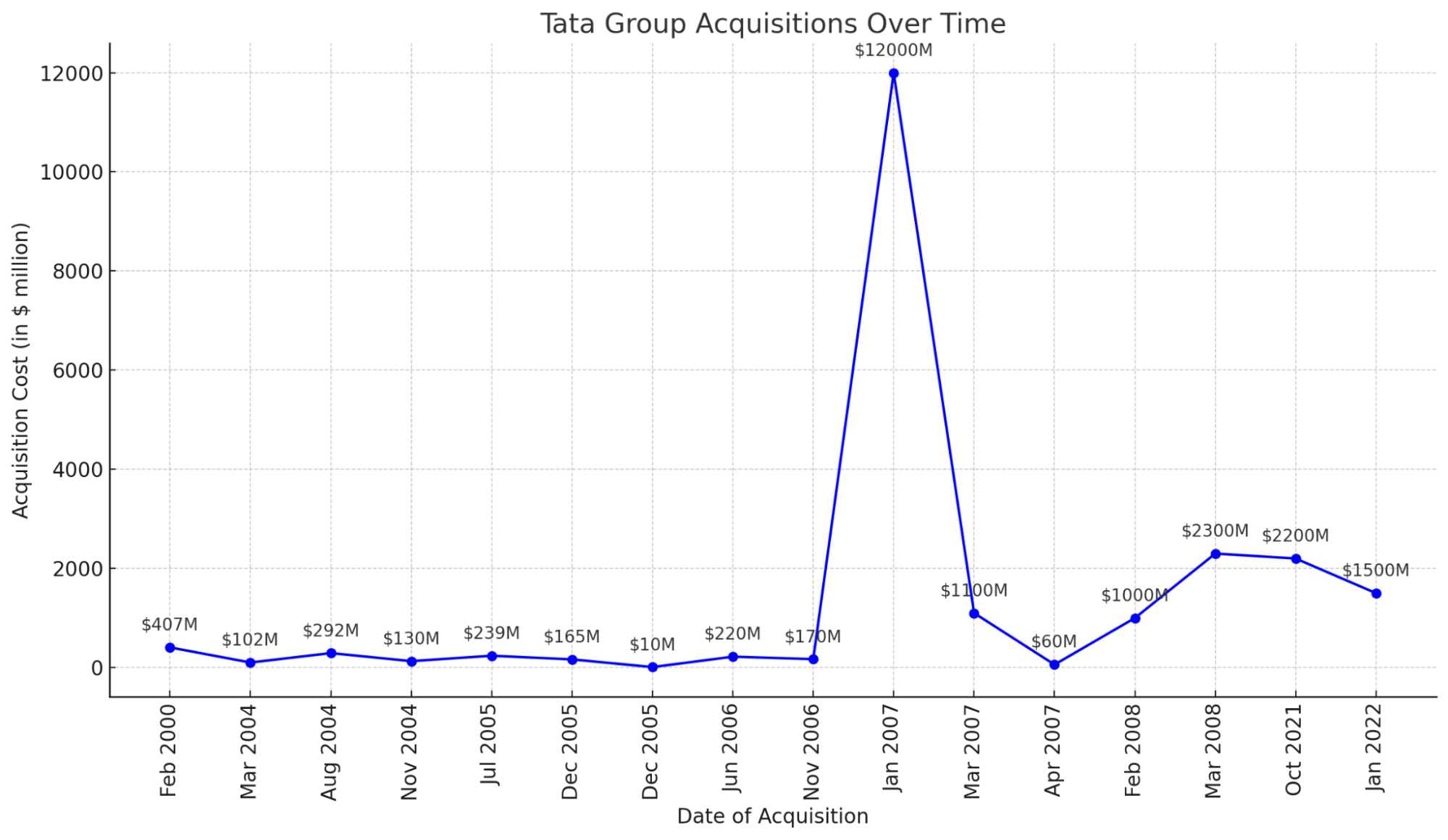

Before showing the bigger picture, let’s take a brief look at the acquisitions that TATA Group made since 2000:

I know it looks pretty scary…But there is nothing to be scared of because we will understand the backstory behind each acquisition.

Ok…So, when Jamsetji Tata founded the Tata Group in 1868 with an initial investment of ₹21,000 (about $300 in today’s currency), no one could have imagined that this modest venture would grow from humble beginnings in India to become a global powerhouse. Tata’s journey is a classic tale of ambition meeting opportunity. But let’s not get ahead of ourselves—let’s take a stroll down memory lane.

| Year | Company | Sector | Acquisition Value (USD billion) |

| 2000 | Tetley | Consumer Products | 0.407 |

| 2001 | VSNL | Telecom | 1.18 |

| 2004 | Daewoo Commercial Vehicles | Automotive | 0.102 |

| 2005 | Good Earth | Consumer Products | 0.032 |

| 2006 | NatSteel | Steel | 0.421 |

| 2007 | Corus | Steel | 12 |

| 2007 | Energy Brands (Glaceau) | Beverages | 4.1 |

| 2008 | Jaguar Land Rover | Automotive | 2.3 |

| 2008 | Serviplem | Construction | 0.02 |

| 2010 | British Salt | Chemicals | 0.134 |

| 2011 | Aldgate Tower | Real Estate | 0.35 |

| 2013 | Oriental Hotels | Hospitality | 0.056 |

| 2014 | e-Nxt Financials | Financial Services | 0.042 |

| 2015 | Tata Chemicals Magadi | Chemicals | 0.1 |

| 2017 | Tata Technologies | Technology | 0.3 |

| 2018 | Tata Steel BSL | Steel | 0.59 |

| 2019 | Usha Martin | Steel | 0.35 |

| 2020 | Tata Power Renewable Energy | Energy | 1 |

| 2021 | BigBasket | E-Commerce | 1.2 |

| 2021 | 1mg | Healthcare | 0.23 |

| 2022 | CureFit | Healthcare | 0.15 |

| 2023 | Kaleyra | Telecommunications | 0.1 |

| 2024 | Capital Foods | Food & Beverages | 0.0006 |

It all started in February 2000 when Tata acquired Tetley Tea Company for $407 million. I remember thinking, “Tea? Really?” But then it hit me—what better way to make a global statement than by acquiring the world’s second-largest tea company? It’s like they were saying, “We’re here, and we’re ready to play on the world stage.”

Fast forward to 2004, and Tata is on a roll. They acquire Daewoo Commercial Vehicle Company for $102 million and NatSteel’s steel business for $292 million. The moves into the automotive and steel industries weren’t just random picks. They were calculated steps into sectors that would bolster Tata’s industrial clout. “Strike while the iron is hot,” as the saying goes, and Tata was certainly heating things up.

Ratan Tata commented on Tata’s broader approach to acquisitions, saying: “We look for businesses that align with our values and strategic direction, and that offer a platform for future growth.” He emphasized that the Tata Group prefers to focus on long-term synergies rather than short-term gains.

In 2007, Tata made headlines again by acquiring Corus Group for a whopping $12 billion. That’s billion with a “B”! This wasn’t just a purchase; it was a bold move into the global steel industry. “Fortune favors the bold,” and Tata was embodying that spirit.

But what’s the method to this madness? Is Tata just buying companies for the sake of expansion, or is there a strategic plan in place?

Well, if we look closely, a pattern emerges. Tata’s acquisitions span various sectors—tea, steel, chemicals, automobiles, telecommunications, and even airlines. It’s like they’re building an empire that’s as diversified as it is robust. This reminds me of the classic investment advice: “Don’t put all your eggs in one basket.” And Tata seems to have taken this to heart, spreading their influence across industries and geographies.

Remember the movie “Moneyball”? It’s all about using data and strategy to build a winning team. I feel Tata is doing something similar—acquiring strategic assets to create a synergy that’s greater than the sum of its parts.

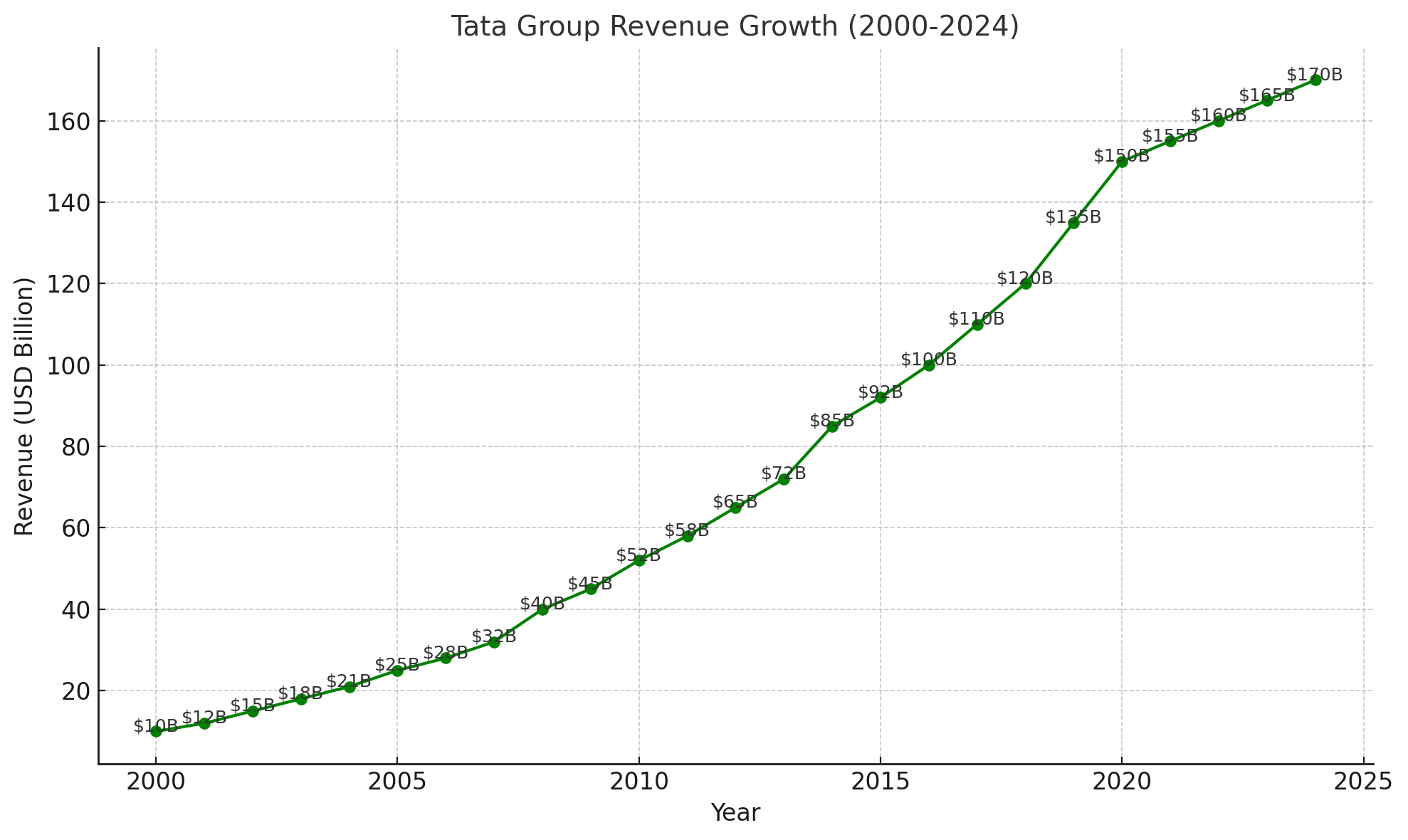

If you look at the graph below, it shows a steady increase in the revenue of TATA Group…Like not a single fall.

Take the acquisition of Jaguar and Land Rover in 2008 for $2.3 billion. Many skeptics questioned this move, especially during an economic downturn. But Tata turned it into a success story, reviving the brands and boosting their global presence. It’s a classic underdog tale—“When life gives you lemons, make lemonade.”

But it’s not just about growth; it’s about portraying a brand image. Tata is known for its ethical business practices and corporate social responsibility. By acquiring companies across the globe, they’re not just expanding their business but also exporting their values. It’s like they’re saying, “We can do business, and we can do it the right way.”

I can’t help but draw parallels with the TV show “Billions,” where strategy, power plays, and corporate maneuvers take center stage. While “Billions” showcases the cutthroat world of hedge funds, Tata’s journey seems to be a more principled approach to building a global empire.

So, what’s the endgame here? Is Tata aiming to be the world’s most diversified conglomerate? Or are they setting an example for emerging market companies on how to go global?

I believe it’s a bit of both. By capturing companies across various sectors and countries, Tata is not just growing—it’s redefining what it means to be an Indian multinational. They’re breaking stereotypes and showing that an Indian company can not only compete but also lead on the global stage.

As the saying goes, “Rome wasn’t built in a day,” and neither was Tata’s empire. Each acquisition seems to be a calculated step towards a grand vision—a vision of global presence, diversified assets, and ethical business practices.

But let’s not forget the challenges. Acquisitions come with their fair share of risks—cultural integration, financial burdens, and market fluctuations, to name a few. Yet, Tata seems to navigate these waters with a steady hand. It’s like they’re playing a game of chess, thinking several moves ahead.

One of the most intriguing acquisitions was Air India in 2021. After years of the airline struggling under government ownership, Tata swooped in and acquired Air India, Air India Express, and a 50% stake in Air India SATS for ₹18,000 crore (about $2.2 billion). This move brought the airline back to its original owners, as Air India was once part of Tata before nationalization. Talk about “coming full circle!”

This acquisition wasn’t just about expanding their portfolio; it was about restoring a legacy. It’s as if Tata is telling the world, “We’re not just buying companies; we’re reclaiming our heritage.”

Looking back, one might ask, “What’s in it for us?” Well, as consumers and stakeholders, we benefit from the products, services, and innovations that emerge from such strategic moves. It’s a ripple effect—when a company grows, it often brings along its ecosystem of employees, suppliers, and even the economy.

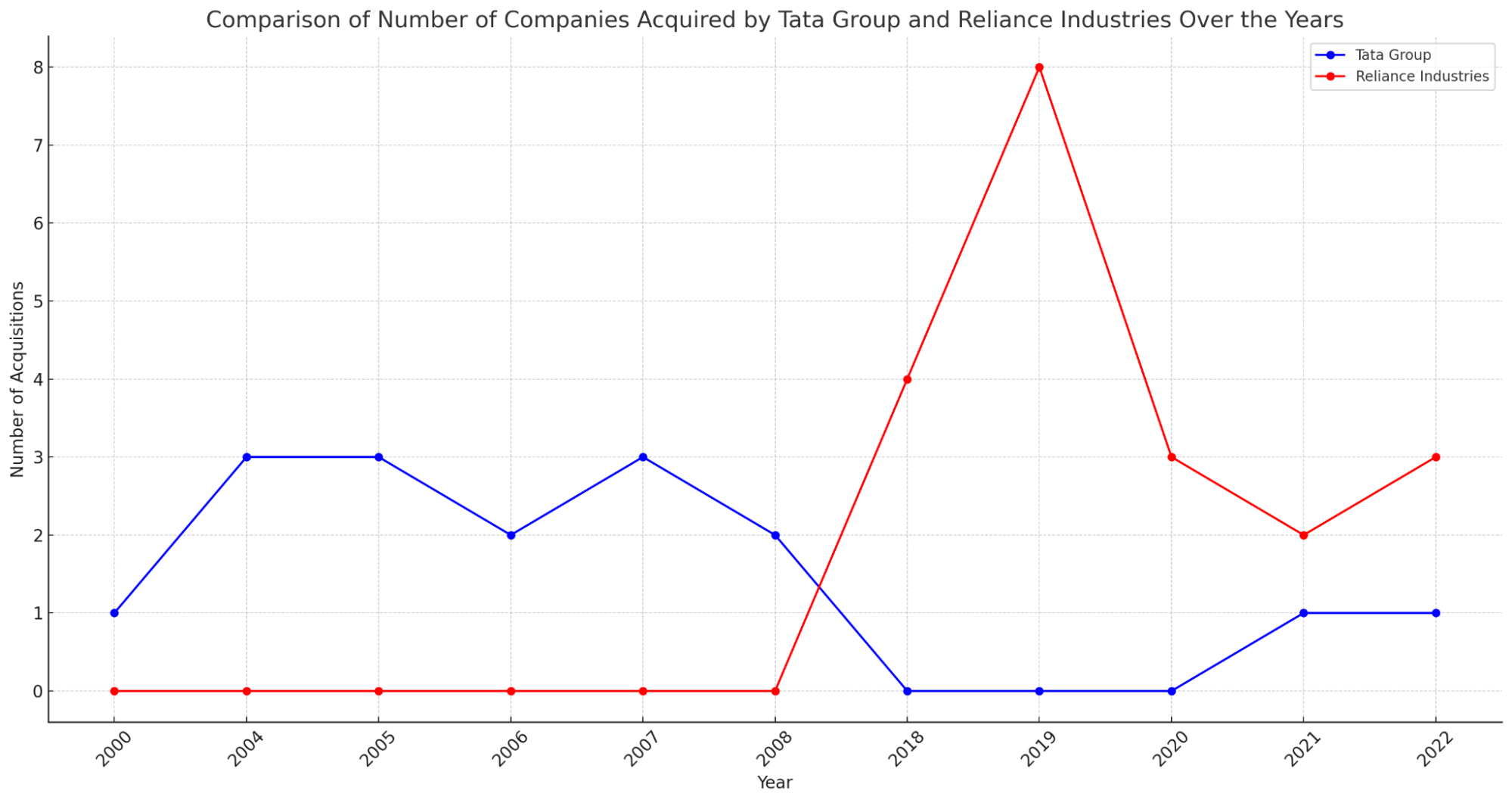

While reflecting on Tata’s vast array of acquisitions, I couldn’t help but compare it with Reliance Industries, another giant that has been making waves in the business world. Let’s visualize their paths with this graph below. It’s intriguing to see how each has played their cards in the corporate game of chess.

In a world that’s increasingly interconnected, Tata’s journey offers valuable lessons. It teaches us about the importance of vision, the power of strategic planning, and the impact of ethical practices. It’s a reminder that success isn’t just about the bottom line; it’s about building something lasting and meaningful.

This reminds me of the saying, “The best time to plant a tree was 20 years ago. The second-best time is now.” Tata seems to have been planting seeds for decades, and now they’re reaping the rewards.

So, next time you sip a cup of Tetley tea, drive a Jaguar, or book a flight on Air India, remember that there’s a larger story behind it—a story of ambition, strategy, and values.

As I wrap up, I can’t help but feel inspired by Tata’s journey. It makes me wonder—what can we learn from this? How can we apply these principles to our own lives and careers? After all, “A journey of a thousand miles begins with a single step.”

Perhaps it’s time for us to take that step, to think big, and to make our own mark on the world.

What do you think? I’d love to hear your thoughts on Tata’s strategy and what it means for the future of global business. After all, as they say, “Two heads are better than one,” and together we might just uncover some insights that could shape our own journeys.